EXCEPT you were born in late 1980s and below, you may not know Mr Emmanuel Odinigwe Nwude. Well, the name rang a bell in mid-1990s after he and his gang scammed Brazil-based Banco Noroeste of $242 million.

It was a scam that involved other persons, including Mr Ikechukwu Anajemba (who later died), Ms Amaka Anajemba, Mr Emmanuel Ofolue, Mr Nzeribe Okoli, Mr Tafida Williams and Mr Obum Osakwe.

Mr Nwude, a former Union Bank director, led the team of the con artists, impersonating the then Central Bank of Nigeria (CBN) Governor, Dr Paul Ogwuma, and selling a fake airport to a director at Banco Noroeste – a bank based in Sao Paulo – Mr Nelson Sakaguchi.

Mr Nwude and accomplices convinced the Brazilian director to invest in a fictitious Abuja airport.

One of the silent culprits was one Mr Williams, who claimed to be a senior official of the Ministry of Aviation. The fake aviation official had claimed that $39 million would be “remitted out of Nigeria as part of fulfilment of the contract for Abuja International Airport,” a document from the United Nations Office on Drugs and Crime (UNODC), seen by Economy Post said.

Mr Nelson Sakaguchi, Brazilian director

The fraudster agreed to pay 40 percent of the money, convincing the Brazilian director to buy into the deal- which turned out to be false.

The greed

Con artists generally seek greedy fellows. Mr Sagaguchi carried out the transactions without involving other directors, Economy Post found.

Without doing due diligence as to who Nigeria’s CBN governor was at that time, Mr Sagaguchi fell for the scam, which has been described as the third highest scam in the world. He first paid $191 million in cash and the rest as outstanding interest.

Ms Amaka Anajemba

Transactions were carried out through Swift Transfer from Banco Noroeste Bank’s Cayman Island Branch to various persons. The UNODC document said, “Many of the said transfers were purportedly made by the order of a British Virgin Airline’s company called Stanton Development Corporation.”

“The convicts, after the receipt of the various funds remitted to them through Swift suddenly changed their lifestyle, acquired interest in Nigerian Banks and other companies and also acquired a lot of properties from the proceed of the crime.”

Some reports said that the Brazilian director committed suicide, while others said he faced life jail term.

The investigation

Investigations began in August 1997 when a bank named Banco Satander wanted to buy Banco Noroeste. Officials of Banco Satande found that a large sum of money -equivalent to two-fifths of Noroeste’s value – sat in Cayman’s island.

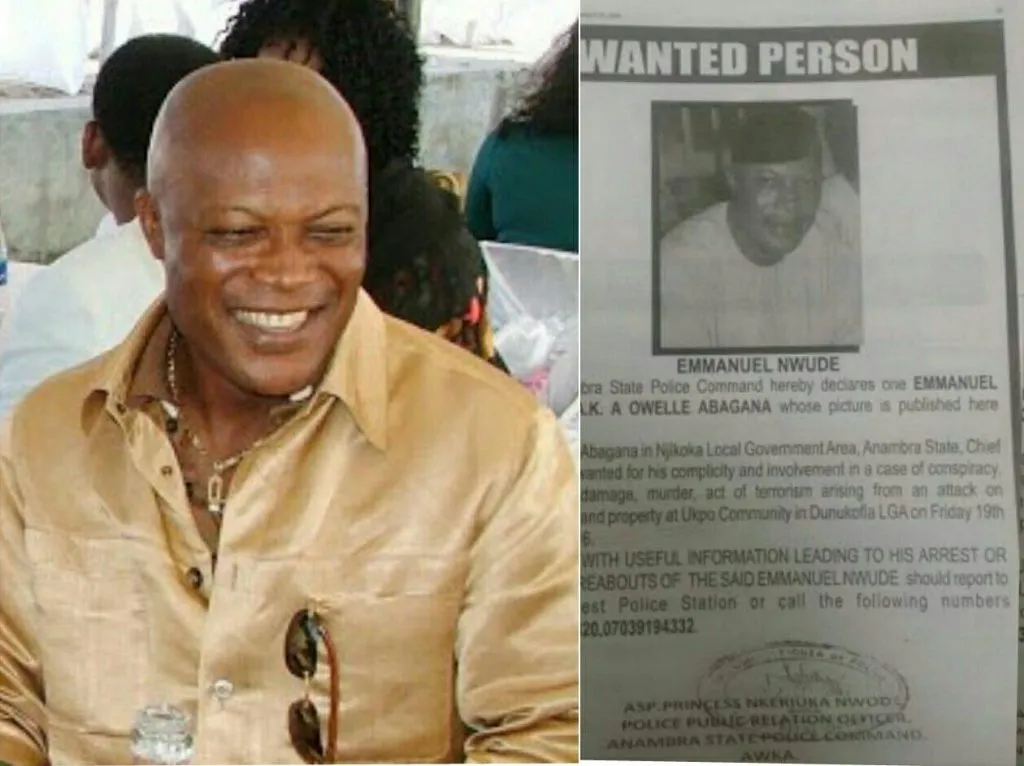

Mr Nwude Source: owaahh.com

Investigations were then conducted in various countries, including Nigeria, Brazil, Switzerland and the United States.

With the unveiling of the scam, the new buyers began to develop a cold feet. Cochrane families, the owners of Banco Noroeste, had to push for the sale to save themselves from the scandal. They had to pay $242 million stolen by Mr Nwude and his gang, but it was already too late.

Banco Noroeste, one of the biggest banks in Brazil, however, collapsed in 2001.[

The EFCC and prosecution

Thanks for President Olusegun Obasanjo who created the Economic and Financial Crimes Commission (EFCC) in 2002, the trial of the scammers began in 2004.

With the courage of the first EFCC Chairman, Mr Nuhu Ribadu, the culprits were prosecuted. During the trail of Mr Nwude, there was a bomb scare, which forced the judge to adjourn proceedings.

After an indicting testimony from Mr Sakaguchi, Mr Nwude and Mr Nzeribe Okoli eventually pleaded guilty. They pleaded with the court for leniency, but the court sentenced them to 29 years in prison.

After his release 25 years after, Mr Nwude filed a suit, claiming that some of the confiscated assets had been acquired before the scam. He has so far recovered $52 million worth of assets from the Nigerian government.

However, Mr Nwude is back in court with his two lawyers after serving his jail term. Mr Nwude is being accused, this time, of forging the documents of a property which a court had earlier ordered him to forfeit to his victims.

Ugwuanyi’s infamous appointment

In 2016, former Enugu State Governor, Mr Ifeanyi Ugwuanyi, appointed Ms Anajemba, an ex-convict, who was said to have posed as finance minister during the Brazil heist, as managing director of the Enugu State Waste Management Agency (ESWAMA).

The appointment atrracted public obloquy, with many wondering why Mr Ugwuanyi was desperate to rehabilitate a thief.

“I was shocked when that appointment happened. There was an attempt to explain it away, but the feelings stuck. It is important for politicians to understand that appointing a fraudster into their governments sends a wrong message to the world that they are not different,” a Social Engineer, Ms Shema Adoni, said.

“She deserves a chance in life, but not in political office. What message are you sending to young people today who are being advised to steer clear of fraud?” she asked.

No lessons learnt

Nigerians are yet to learn anything from the Brazil heist. Not minding that Mr Nwude and his accomplices are being avoided like snakes by the society, many Nigerians have continued to perpetrate similar crimes across the world.

In November 2022, Mr Ramon Abbas, known as Hushpuppi, was jailed 11 years by a United States’ judge and ordered to pay $1.7 million to two fraud victims, a statement from the United States Department of Justice said.

Mr Abbas, now 42, was instrumental in laundering $14.7 million stolen by North Korean hackers from a bank in Malta, Al Jazeera reported.

In October 2023, one Alex Ogunshakin was extradited to the United States of America (USA) over $6 million fraud.

A Nigerian, Mr Olugbenga Lawal, was sentenced to 121 months in US prison for conspiring to launder money derived from internet fraud.

Similarly, a Nigerian, Mr Kingsley Ogbeide, and his girlfriend, Ms Vemuna Katjaimo, was sentenced on January 18, 2024, to 87 months in US prison for wire fraud charges.

In 2019, Mr Bonaventure Chukwuka, Mr Emmanuel Chukwuka, Mr Christian Chukwuka, Mr Andrew Chukwu, Ms Queen Chukwuka, and Ms Grace Chukwuka (five members of one family) were jailed by six United Kingdom courts for online scams valued at over £10 million.

A retired staff member of an anti-corruption organisation in Nigeria, who did not want his name in print, said Nigerians must change their value system.

“I have seen a lot to convince me that corruption knows no tribe or religion. I have seen people from 6 or 7 ethnic groups involved in the same fraud. Our social values must change and there must be harder punishment for crimes in Nigeria. So, we need our laws to be amended to severely punish online scammers, thieves in political office.

“Every department in Nigeria must play its role. We must expose crimes and report anybody we suspect is a fraudster in our midst,” he added.