…MSMEs borrow at 29-35% rate at bank

One of Nigeria’s Tier-1 banks, Zenith Bank Plc, has lent N3.517 billion to its management staff at four percent interest rate, Economy Post can authoritatively report.

This was revealed in the bank’s second-quarter 2023 financial statement recently released to the Nigeria Exchange Limited (NGX).

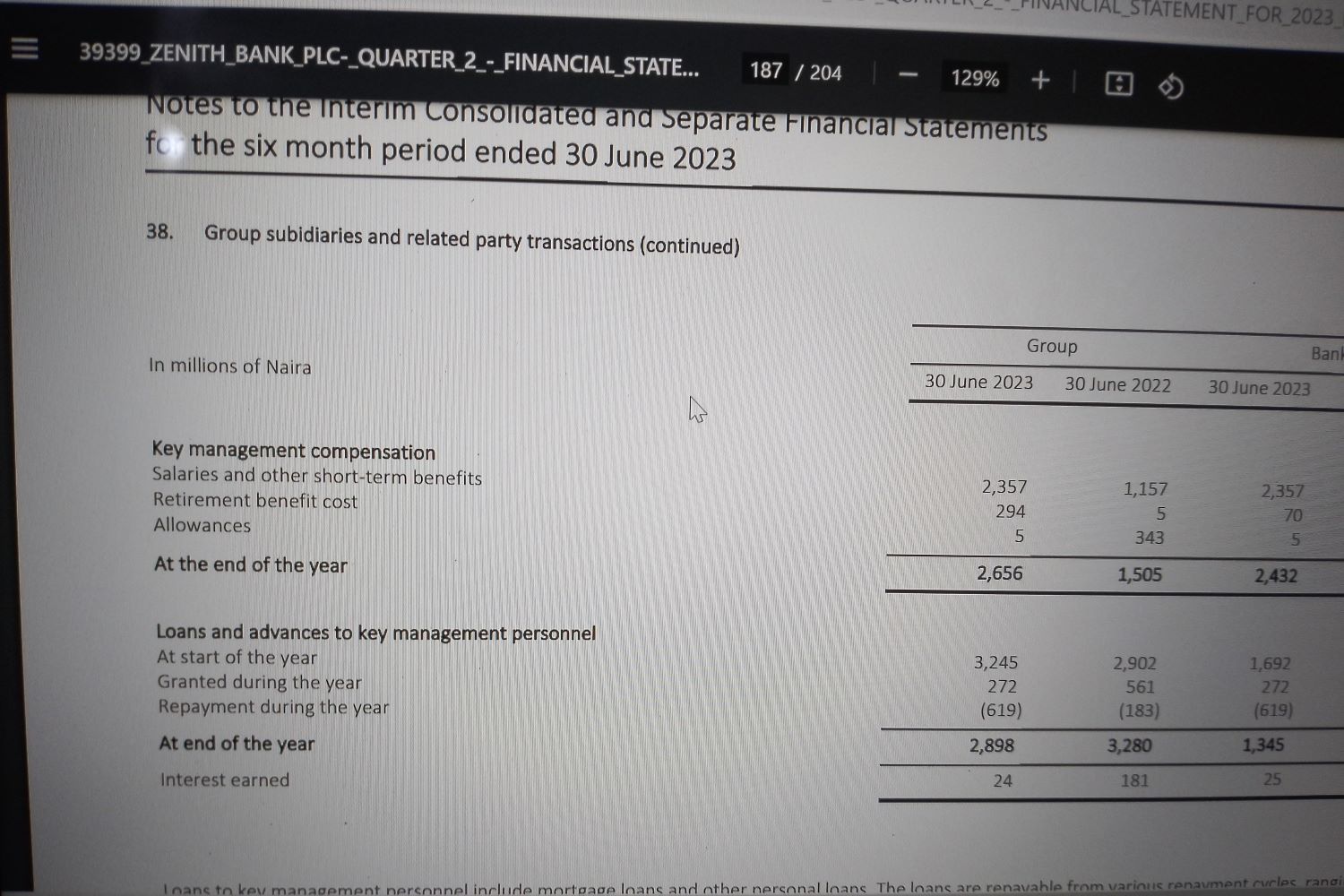

At the start of the financial year in January 2023, Zenith Bank Group’s loans to the management staff stood at N3.245 billion. However, the bank granted an additional N272 million to them within the year, bringing the value of total loans to N3.517 billion.

So far, the bank’s management staff have repaid only N619 million, which is just 17.6 percent of the total obligation. Hence the current balance yet to be repaid by Zenith Bank’s management staff is N2.898 billion.

Zenith Bank granted most of the loans to its management staff to acquire land and build houses, while some were given to them as personal loans.

“Loans to key management personnel include mortgage loans and other personal loans. The loans are repayable from various repayment cycles, ranging from

monthly to annually over the tenor and have an average interest rate of 4%,” Zenith Bank admitted in its second-quarter financial statements.

“Loans granted to key management personnel are performing,” it further said.

Understanding the problem

The Central Bank of Nigeria (CBN)’s current monetary policy rate (MPR), which is the benchmark interest rate, stands at 18.75 percent. A benchmark interest rate determines other rates in the economy, meaning that banks cannot lend below the rate.

As at January 2023 when Zenith Bank’s loans to its management staff were put at N3.245 billion, the CBN’s MPR or benchmark interest rate was 17.5 percent. However, the bank had no problem granting loans to its management staff at four percent interest rate

Ordinarily, when a customer borrows loans from Zenith Bank or any other deposit money bank in Nigeria, the interest rate changes once the CBN benchmark rate changes. This means that customers who borrowed in January 2023 at 20 percent rate would have had their interest rates changed three times since then. This is because the CBN Monetary Policy Committee (MPC) has changed the MPR or benchmark rate three times since January.

Interestingly, Economy Post found that even when the benchmark rate has changed from 17.5 percent to 18 percent, and to 18.5 percent, and to 18.75 percent since January 2023, Zenith Bank’s interest rate to its management staff has remained the same – at four percent.

Zenith Bank’s high interest rates

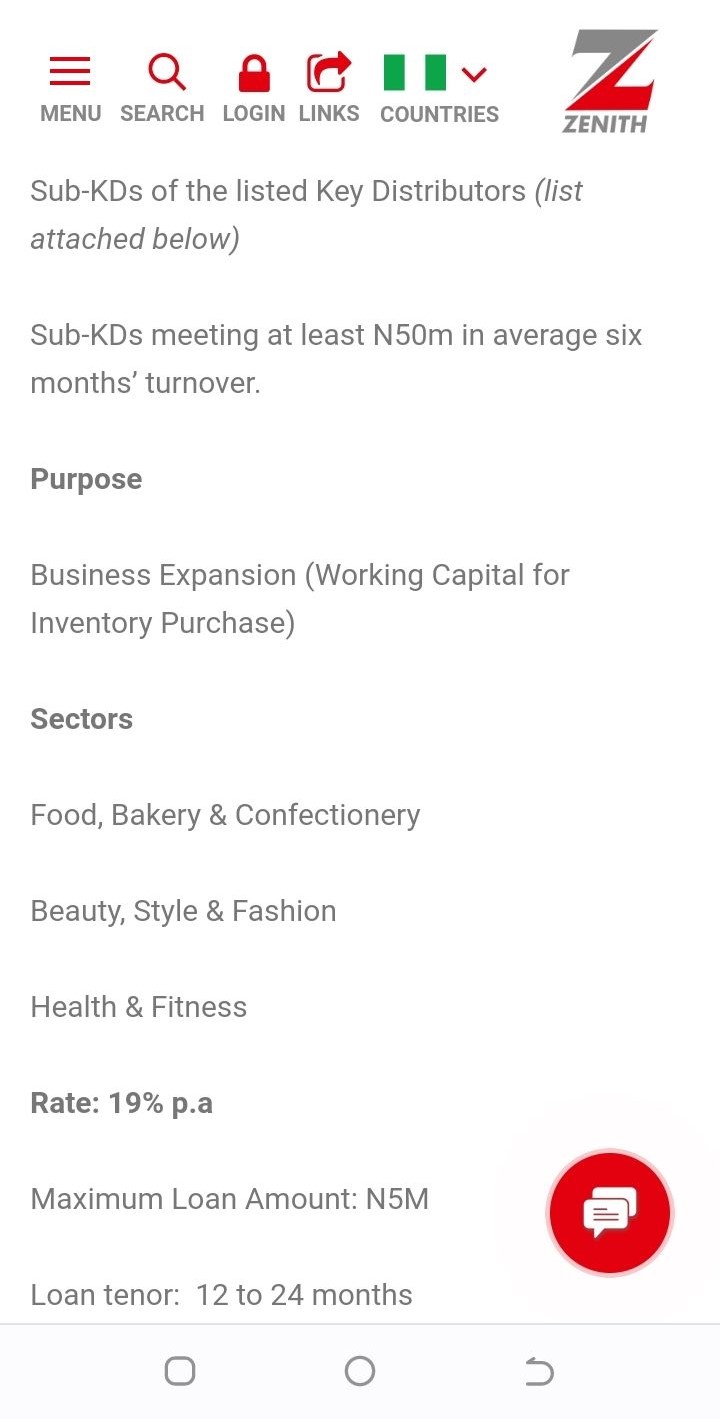

Zenith Bank’s loans to customers hover between 20 percent and 35 percent. As at 2022, interest rate for the bank’s SME Sub-KD /Sub-Dealer Scheme was 19 percent per annum. But this has increased to over 20 percent.

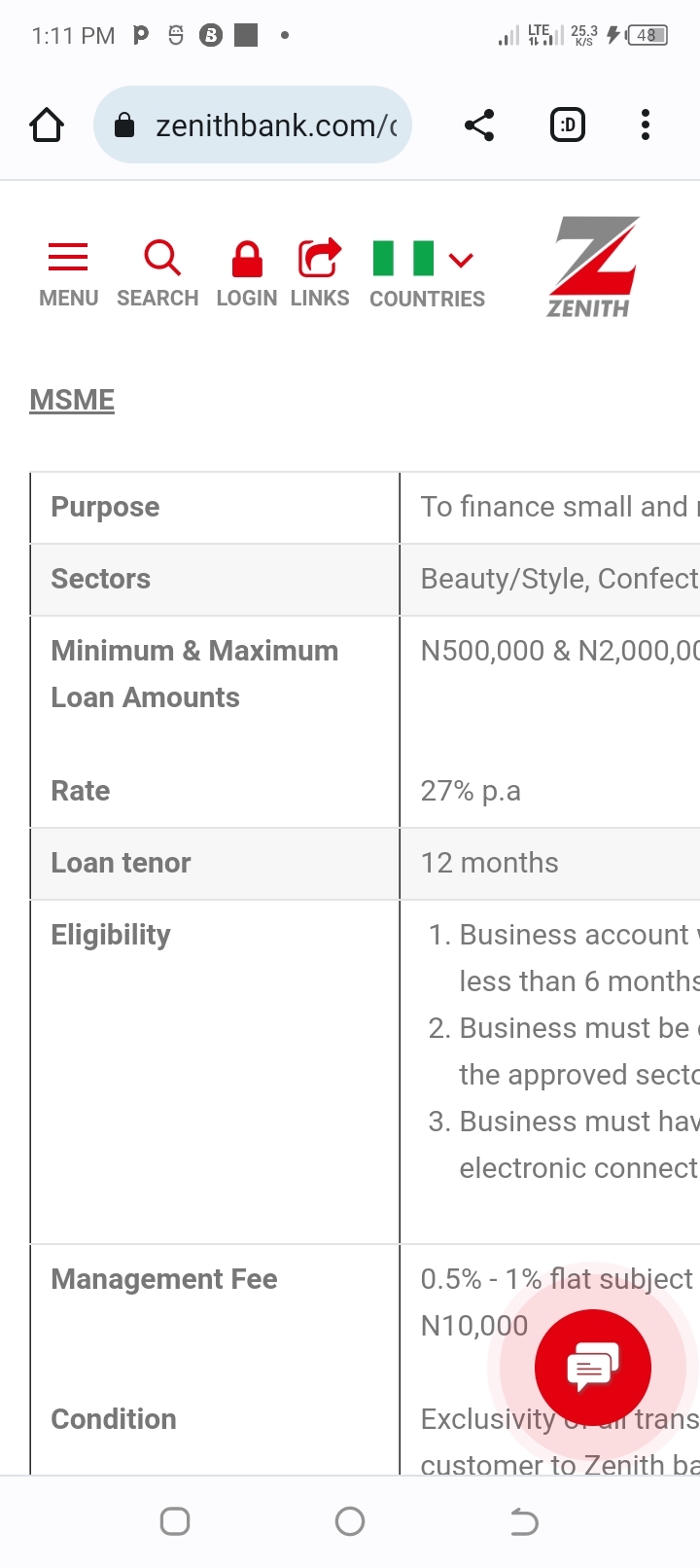

While the CBN and small businesses complain that they cannot have access to funds owing to high interest rates, Zenith Bank’s advertised rate for micro, small and medium enterprises (MSMEs) loan was 29 percent per annum. Tenor of the loan is 12 months. There is also a management fee of 0.5 percent to one percent to be paid before a small business owner can access the loan.

Zenith Bank’s management staff earned N2.656 billion in salary, short-term benefits, retirement benefits and allowances by the end of the financial year.

MSMEs kick

Operators of MSMEs have criticised Zenith Bank for lending depositors’ fund to its management staff at four percent interest rate when they could only get loans at rates above 25 percent.

Chief Executive Officer of Lagos-based Jasen Fashions, Ms Jane Idemudia, said the situation only reflected the state of Nigeria’s financial system.

“It is a laughable situation that a bank pays more attention to its senior staff than those without which it cannot be in business. As an entrepreneur, we hardly have access to cheap loans. Even when government intervention loans are available, you cannot access them unless you know someone in a bank. So, this situation is just a reflection of what the country’s banking system has become,” she said.

An Abuja-based operator of food business, Ms Vivian Emodi, said she was not surprised. According to the 32-year-old entrepreneur, she went to a bank seeking some funds in 2021 but could not get due to a high interest rate.

“I went to a bank to get some loan in 2021, but I was told I could only get it at N23 percent. I could not even get any of the CBN loans,” she said.

Normal practice

Meanwhile a former staff member of a Tier-1 bank, Mr Otienne Maxwell, said this was a normal practice in deposit money banks.

“It is nothing strange in banks. But it’s not all bank workers that can get loans. It is often reserved for those who are full staff (not contract staff), and mortgage loans are for senior staff.

“As for the terms of loans, they are determined by the banks. If a bank decides four percent is good for its staff, it is no problem. However, it is absolutely wrong to give out depositors’ money at four percent rate when the repo or benchmark rate is nearly 20 percent. It is often meant to compensate staff for their efforts, but do not bring it so low,” he added.

Zenith Bank keeps mum

Head of Corporate Affairs at Zenith Bank, Mr Ayoola Kusimo, did not respond to text and WhatsApp messages sent to him for a response on the rationale behind the provision of loans to the bank’s management staff at four percent interest rate.